Many terms related to equity derivatives trading are not easily understood. Option, call and put are also included in such words. What is their meaning and how are they used in the context of the market, know here. 1. What are equity options? You must be eating yogurt. Its prices depend on milk.

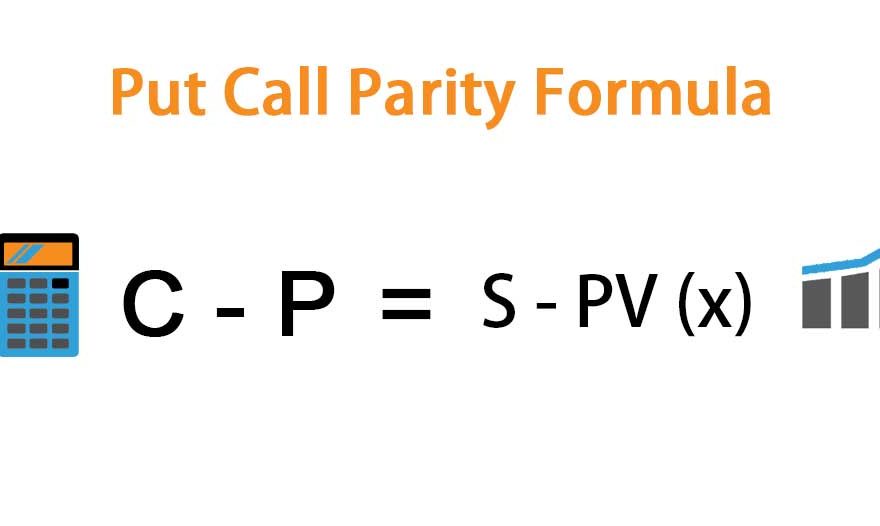

If you want to know about put call parity then click on the link.

If milk is expensive, the price of curd will also increase Similarly, the value of equity option depends on indexes lik Nifty and Bank Nifty. There are two types of these instruments. Call and put option. You can trade in the call or put of an index or a stock.

- What are equity options?

You must be eating yogurt. Its prices depend on milk. If milk is expensive, then the price of curd will also increase. Similarly, the value of equity options depends on indexes like Nifty and Bank Nifty. There are two types of these instruments. Call and put option. You can trade in the call or put of an index or a stock.

- What are call and put options?

The buyer of the call gets the right to buy the underlying stock (which will affect the call if prices fall or decrease) at a fixed and fixed price.

These are purchased by paying premium. It is a part of the total price. Similarly, in a put, the buyer gets the right to sell the shares. The seller selling the call gets a premium from the buyer. It has to give shares to the buyer at the price of the contract. Similarly, the put seller has to sell the shares.

- How do they actually work?

Let’s say on December 21, the trader buys a call of 10,800 from the Nifty. Its duration is to end on 27 December. Suppose the price of each share of the call is Rs 62.

There are 75 shares in a contract. Let’s say the Nifty closes at Rs 10,900 on December 27. In this way, 100 rupees will be called ‘in the money’ in 10,800 calls. In this, the seller of the call will pay the trader in the ratio of 100 rupees. That is, on every share of Rs.

- How is it different from Future?

In the illustration you saw that the buyer’s loss is limited to the premium paid. However, the seller’s loss of calls and puts can be unlimited. Practically the buyer of calls and puts can have unlimited benefits. In the case of the future there is no limit to the profit or loss of the buyer or seller.

- What are the types of options?

There are two types of options. American and European. In American style, the option can be bought and sold at any time during the contract period. At the same time, in the European style, this can be done only on the maturity of the contract. In this, the deal is automatically cut on the last day of the contract.

The door for ‘hat-trick seats’ has also opened in the 2020 elections for the Aam Aadmi Party, which contested the Delhi Assembly elections for the first time in 2013. In fact, there are 27 seats on which the party has won in both the 2013 and 2015 elections, and the party will keep an eye on putting hat-trick on these seats. Apart from this, 17 of the 46 MLAs who have been re-ticketed in the election this time, 17 MLAs are also involved in the race to impose a hat-trick.

Who all are there in the hat-trick race?

Chief Minister Arvind Kejriwal from New Delhi seat, 17 MLAs and candidates, including Deputy Chief Minister Manish Sisodia from Patparganj seat, are involved in the race for hat-trick. MLA Saurabh Bhardwaj from Greater Kailash, Sanjeev Jha from Burari, Rakhi Birla from Mangolpuri, Bandana Kumari from Shalimar Bagh, Satyendar Jain from Shakur Basti, Akhilesh Pati Tripathi from Model Town, Somdutt from Sadar seat, Special Ravi from Karol Bagh seat, Madipur seat Girish Soni from Tilak Nagar, Jarnail Singh from Vikaspuri, Mahinder Yadav from Vikaspuri, Madanlal from Kasturba Nagar, Somnath Bharti from Malviya Nagar, Prakash Jarwal from Deoli, Dinesh Mohania from Sangam Vihar seat are included in this race.

For getting do follow backlinks on your site, check out “Insurance Write For Us” page.

Four candidates who won in 2015 but won on AAP ticket in 2013 were the other candidates

2,699 total views, 3 views today