India is a country of 1.5 billion unique people. Therefore it has a huge consumer base. A larger consumer base creates the demand for multiple products and services and the necessity of businesses to offer the same. Nowhere is the diversity of people more evident than in India. This diversity leads to demand for unique products that cater to the needs of different people.

We first have to understand working capital meaning, to understand the true nature of a working capital loan. Some businesses are seasonal in nature, and some have high debtor’s turnover period. These factors, along with a few others, determine how much money a business will require to consistently maintain its production volume and process.

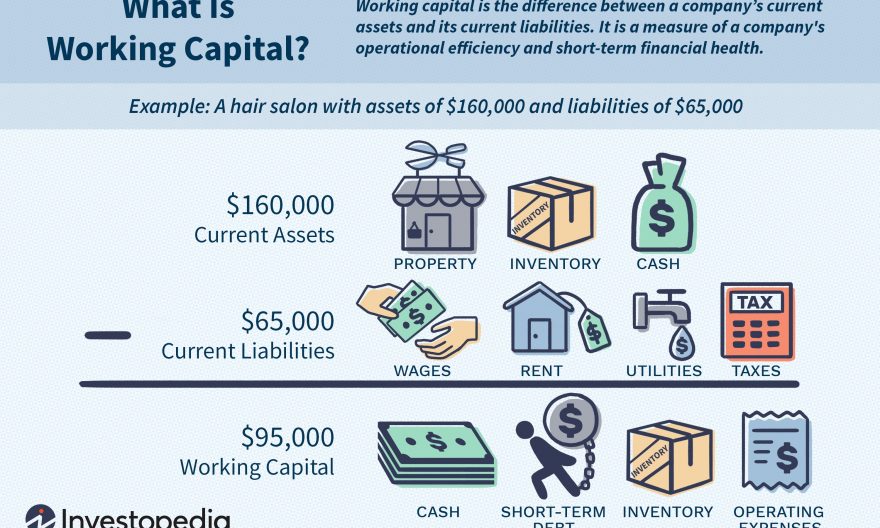

What is Working Capital?

Working capital meaning, as the name suggests, is the amount of money required to keep the business running. Working capital is the funds required by a business to meet its short-term liabilities. An example would be, the funds needed to pay off creditors/suppliers.

It is always ideal for a business to pay off their current liabilities as soon as they accrue. This reduces the working capital requirements of a business and motivates the creditors and suppliers to input more in the business.

Popular economic theories prove that delay in accrued payments is bad for businesses and by progression, the economy. This is due to inflation which suggests that a sum of money loses its purchasing power over time.

Therefore, it is wise not to defer the payments. If your business is going through a cash crunch, it is time to consider a working capital finance for a cushion of funds to ease your cash crunch worries.

3 Reasons why a working capital loan is best suited for your business

- Seasonal business –

If your business is seasonal in nature, the requirement of working capital must be a worrisome topic for you. Your sales accrue for a limited period of time, but you have to maintain your resources around the year. The trouble starts when sales begin to drop and you do not have money to maintain your current assets. This causes you to raise personal loans at higher rates causing more harm to your financial strength than good. It is also an aggressive policy of financing working capital meaning that it entails certain inherent risks. Z

Long production cycle –

Some businesses require a longer period of time to complete a production cycle. There can be many underlying reasons such as:

- Raw materials remain in store for a long period of time.

- Requirement of seasonal raw materials which are available only for a short period of time in a year.

- Finished goods stay in the store for a long period of time.

It is essential to manage working capital for a manufacturing concern. There is a long list of reasons. The amount of time required for the production of a single unit of the output has a direct relation with the requirement of working capital. There have been recorded cases of individuals using personal loans to finance their business working capital needs. This is because of a lack of knowledge about business finance meaning.

- High debtor’s turnover period –

Debtor’s turnover period refers to the time taken by a debtor to pay their dues. Some buyers take a long time to pay their accrued bills. This adversely affects business liquidity because they have to depend heavily on external funds to maintain the optimum current ratio. It is quite frustrating for a business concern to go through a period of cash crunch every time sales graph hits a peak. Therefore, working capital finance are the way forward for businesses that face the above-stated problems or similar cash crises.

Working capital loans are explicitly designed to fit your businesses working capital requirements. If your business has the above-stated problems, consider opting for a working capital loan.

4,711 total views, 3 views today